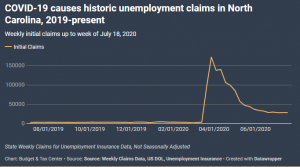

COVID 19 has caused historic job losses. Across the state workers and their communities, industries and the broader economy are facing significant harm because job losses lead to reduced spending and lost opportunities.

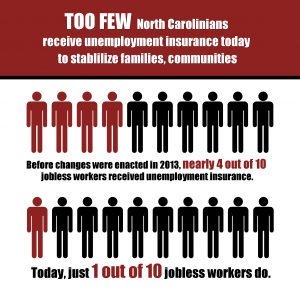

Too few jobless workers receive too little in unemployment insurance to sustain their families, support the economy for too short a period given the lack of jobs.

Learn more about the state Unemployment Insurance and why past choices have made our state less resilient in the face of COVID-19 by visiting the links below.

Too few jobless workers receive too little in unemployment insurance to sustain their families, support the economy for too short a period given the lack of jobs.

Action opportunity: download and share these graphics on social media.

Policy Innovations that Support Jobless Workers and Communities

The North Carolina General Assembly can adopt a number of policy changes that Support Jobless Workers and Communities:

Four ways to Help Unemployed Workers and North Carolina’s Struggling Economy

NC Justice Center Brief: Work Sharing

Get the latest on the Regional Unemployment Insurance Dashboard.

Fact sheets and reports:

- Unemployment Insurance Changes Needed in North Carolina (January 2021)

- A proposed Unemployment Insurance change: Work Sharing: Another tool in the toolbox for businesses to avoid layoffs (December 2020)

- Jobless workers in NC need more certainty (August 2020)

- Every county needs the stabilizing force of UI (August 2020)

- UI will strengthen recovery from COVID-19 (June 2020)

- Women more likely than men to file for unemployment in 2020 ( June 2020)

- Women and people of color are losing jobs at higher rates than white men right now (May 2020)

- Unemployment insurance changes needed in NC (April 2020)

- Know Your Rights: Your Employment and COVID-19 (March 2020)

- Sound Unemployment Insurance that serves workers is critical (March 2020)

- Learn more about your rights, legal services, the latest news and other COVID-19 resources.